Insurance customer 360: automate, personalize, accelerate and grow customer acquisitions with AI and ML

Digitization is revolutionizing the way the insurance industry does business, with newfound ability to automate, personalize, and accelerate customer growth through artificial intelligence and machine learning. These changes benefit both insurance companies and customers in the long run: Insurers are able to process large amounts of customer data at an unprecedented rate, while customers delight in a more streamlined, personalized experience.

Our smartphones, fitness trackers, social media activity, online shopping and other digitally-connected enablers make our everyday lives easier, and also produce tons of data about our habits, health, and decision making – in other words, information that insurance companies can leverage to improve customer-facing business processes. McKinsey predicts that by 2025 there will be one trillion connected devices. This surge in data will lead to a better understanding of insurance customers’ needs, help to identify cross-sell and up-sell opportunities, and inform the development of new product categories, more personalized pricing, and real-time service delivery.

Why is there a need for a 360-degree customer view in insurance?

How do insurance companies navigate through a vast sea of data to identify individual customer needs? How can they offer coverage in multiple spheres (i.e., home insurance, health insurance, etc.), inform the underwriting process, accelerate the claims handling process, and improve customer convenience? There is an overwhelming need for insurance companies to have a unified view of each customer with all the relevant customer data available to all the relevant insurance ecosystem stakeholders to resolve the questions above.

Benefits of obtaining a 360-degree view of the customer

Introducing intelligent workflows will streamline the relationship between insurance companies and their customers. Gartner reports that 50% of chief sales officers will shift their focus from being leaders of sellers to being leaders of selling in the coming years. In other words, business trends point to customers preferring less human interaction and more self-service.

A well-rounded and digitized customer experience is therefore more necessary than ever for insurance companies to get ahead in increasingly competitive markets. There are a multitude of benefits, including:

- Easy access to customer data for in-depth analysis;

- Customer satisfaction and retention through personalization of user experience;

- AI-driven workflows which deliver faster and better results.

In-depth analysis of customer data

Not all data is created equal. These days, there is an infinite amount of internal and external data available on customers. How do insurance companies pinpoint which data is the most useful for identifying customer needs? This is where customer intelligence and the Next Best Action Model come in. By using predictive analytics and modeling tools, insurance companies can supplement the primary data on their internal servers with the data drawn from other communication channels.

Grid Dynamics builds customer acquisition solutions which collect both first- and third-party data that feed into statistical models for lead scoring, and integrate models with transactional systems, marketing automation software, and external advertising platforms. Besides customer claim details and recent transaction history, first-party data might refer to the basic information identifying a customer. This would include a customer’s income, age, occupation, etc. If their insurance plan also includes family members, there need to be details that identify each one and their relationship to the primary policyholder. Third-party data might relate to social media, online purchases, IoT sensor data, and so on.

Optimizing this data can lead your business to automate much of the daily decision-making process and, as such, offer more personalized user engagement to your customers. This is because machine learning algorithms look for patterns and market trends to provide the best insight. Predictive analysis models drawn from these data provides insights into customer behavior that will ultimately improve your business’ customer retention rates over time: it leads to greater risk analysis, fraud detection, and message targeting–not to mention, it allows you to focus more on core business processes.

Customer satisfaction

There are multiple factors which contribute to overall customer satisfaction, including clear and precise insurance policy details, being able to file claims with relative ease, and receiving fast, informative replies from insurance agents. When it comes to insurance, every customer’s worst nightmare is having their claim denied and being left with a huge bill. This kind of scenario can come about due to a customer’s misunderstanding of their policy, or missed information on the part of the insurer. Either way, insurance companies and customers need access to comprehensive data.

Filing a claim is a defining factor in the relationship between insurer and customer. If it’s a headache-inducing process for the customer, they are likely to start looking elsewhere for better service. Whether it’s for car repairs following an accident or buying life-saving medicine prescribed by a doctor, customers want transparency and fast results when it comes to reimbursements for financial losses that fall under their policy coverage. Insurance companies need to have an easy-to-navigate platform with a unified view of customer details, a user-friendly website and mobile application to collect and update customer data, and AI-powered virtual assistants to assist customers outside of peak working hours. Customers should also be able to provide feedback or file complaints without hassle.

Implementing an automated, omnichannel approach to filing claims and lodging complaints or service requests streamlines the claims handling and service delivery processes. If customers are able to access their policy details or submit claims via their preferred channels, using any device, it makes the whole process less of a hassle. Furthermore, when all of this data is aggregated onto a single source of truth, it supports the 360-degree view of each customer's unique needs, and enables agents to respond faster and more efficiently.

AI-driven workflows

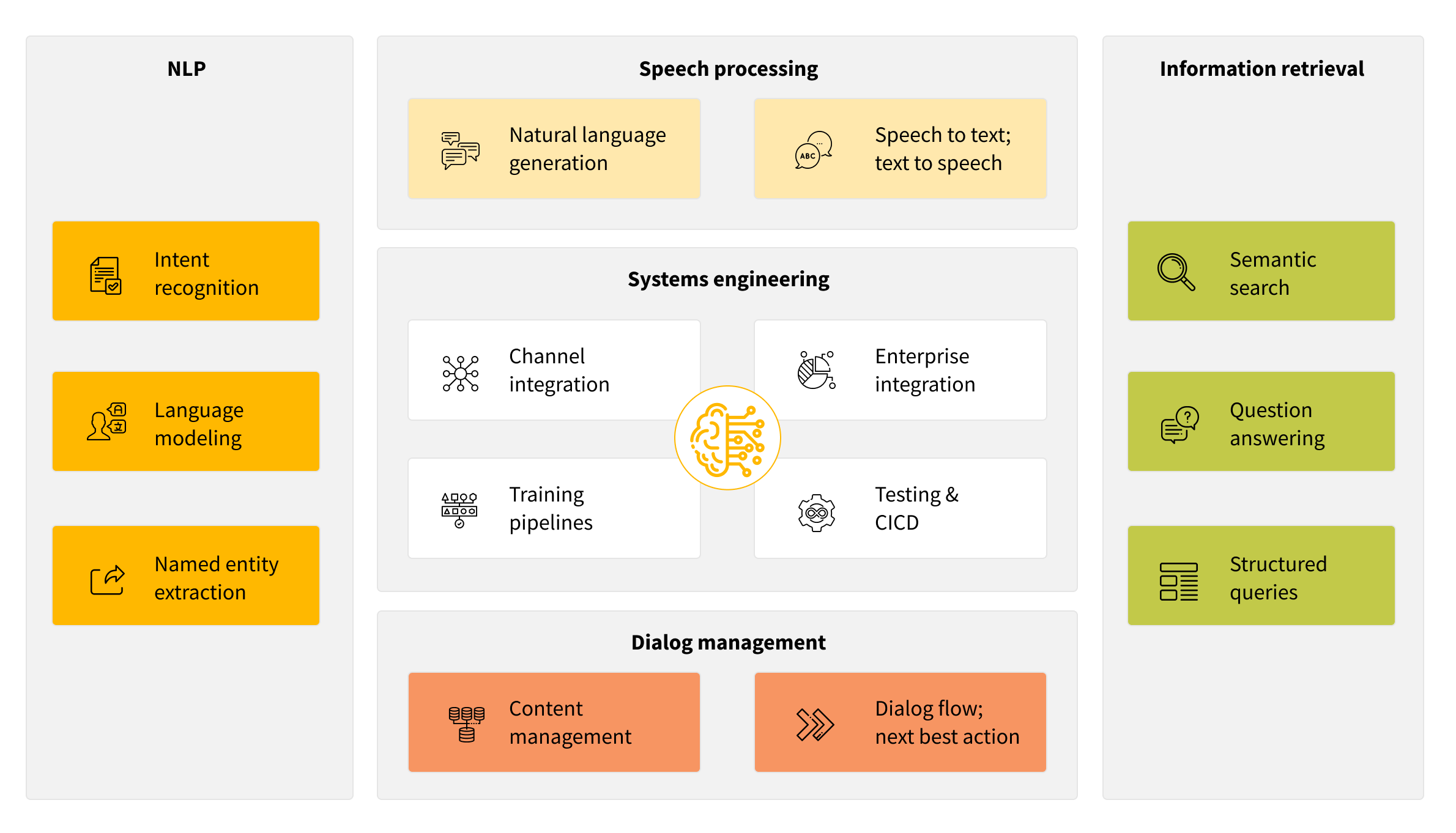

One major tool of an AI-driven workflow for the insurance industry is the virtual assistant. Virtual assistants already supplement the interaction between customers and customer service representatives in a variety of business sectors. Ultimately, they redefine how customers interact with a business and will continue to do so in the future, fielding customers to the right agent or providing them with the necessary information. Their role is to accompany the customer throughout the process, from product discovery to post-purchase support. Grid Dynamics has experience working with major businesses in need of conversational AI systems. Our developers use open-source software libraries like TensorFlow or PyTorch as part of their technology stacks to implement deep learning techniques. Bespoke language models tuned in to your specific domain, be it insurance or otherwise, ensures the best possible understanding of your customer base. The conversational AI can also be supported by various major channels, including Google Home, Alexa, Facebook Messengers, and others.

Deep natural language processing capabilities power conversational AI. Every time the customer interacts with a virtual assistant, it stores and processes that data. As a result, conversational AI becomes better equipped to perform information retrieval through semantic searches and structured queries, providing customers with in-depth and relevant information. Customers can get answers whenever they need them, no matter where they are located.

What is needed to achieve a customer 360 view?

If the prospect of streamlining all this customer data still seems a bit daunting, don’t fret. There are plenty of tools available to help insurance companies build a customer 360 view. We’ve already mentioned some of them, such as the Next Best Action Model, an omnichannel user experience, and conversational AI models, but you still need a platform to process and analyze all of this data. Enter the Grid Dynamics Analytics Platform.

Grid Dynamics Analytics Platform

In order to have a 360-degree view of each customer, you need a solid data platform to process that information. Grid Dynamics has years of experience with data analytics and cloud computing, so we created a best-in-class platform with AWS to optimize data aggregation, analytics and access for forward-thinking, data-intensive enterprises. Our Analytics Platform increases speed to insights, and improves data accessibility and quality, making the implementation of 360-degree customer views easier than ever before.

Traditionally, a lot of insurance companies have their data stored in on-premise EDW software. There are a lot of issues relating to lack of scalability and technology stacks, meaning that your business risks falling behind. Grid Dynamics can help you migrate this data to the cloud to scale your data processing efforts. Optimizing your data-driven processes will put you at the forefront of highly competitive markets.

Let’s sum it up

Insurance companies need to rethink how they approach data in order to increase customer acquisition and retention. The vast sea of data can help to shape a unique view of each customer, leading to improved customer journeys and experiences, as well as greater productivity for insurance companies themselves.

Grid Dynamics is a digital-native technology services provider that accelerates growth and bolsters competitive advantage for Fortune 1000 companies. We have more than 15 years of experience in digital transformation and software innovation, most notably open source cloud-native programs.

Still have questions about 360-degree customer views in the insurance industry? We’d love to hear from you!