A rapid response to COVID-19 supply chain and market shocks: Emerge from the crisis stronger

The COVID-19 crisis is clearly the biggest economic disruption the world has seen in the 21st century. This disruption impacts virtually all industries and all areas of enterprise operations through market demand, supply chain, and human capital.

The adverse impact of the COVID-19 pandemic and prolonged economic recovery will be influenced by many factors, including the public-health response and the effectiveness of government economic policy. For the business world, it clearly indicates a “survival of the fittest” mode of operation:

- In the short term, the ability to resolve the immediate challenges created by the coronavirus outbreak and develop a resilient operational model for the time of virus-related shutdowns will play a critical role.

- In the long term, the ability to use the shutdown time wisely, prepare the organization for a rapid rebound, and rescale the business in the “next normal” created by COVID-19 will be increasingly important.

Every crisis is an opportunity, and it is important to view the coronavirus situation not only in terms of crisis fighting but also within a strategic context. It is vital for business leaders to recognize the opportunities created by changes in the competitive landscape, consumer behavior, and supply to navigate through this challenging time and emerge from the crisis stronger. Conversely, the failure to understand these next horizons could be fatal.

In this article, we provide some practical recommendations to technology and business leaders on how advanced data analytics and engineering capabilities can be leveraged to rapidly and efficiently respond to the COVID-19 disruption. These recommendations are largely based on early examples of response actions we have already observed across the industries.

Introductory Case Study: Shock-Corrected Revenue Management for a Media Company

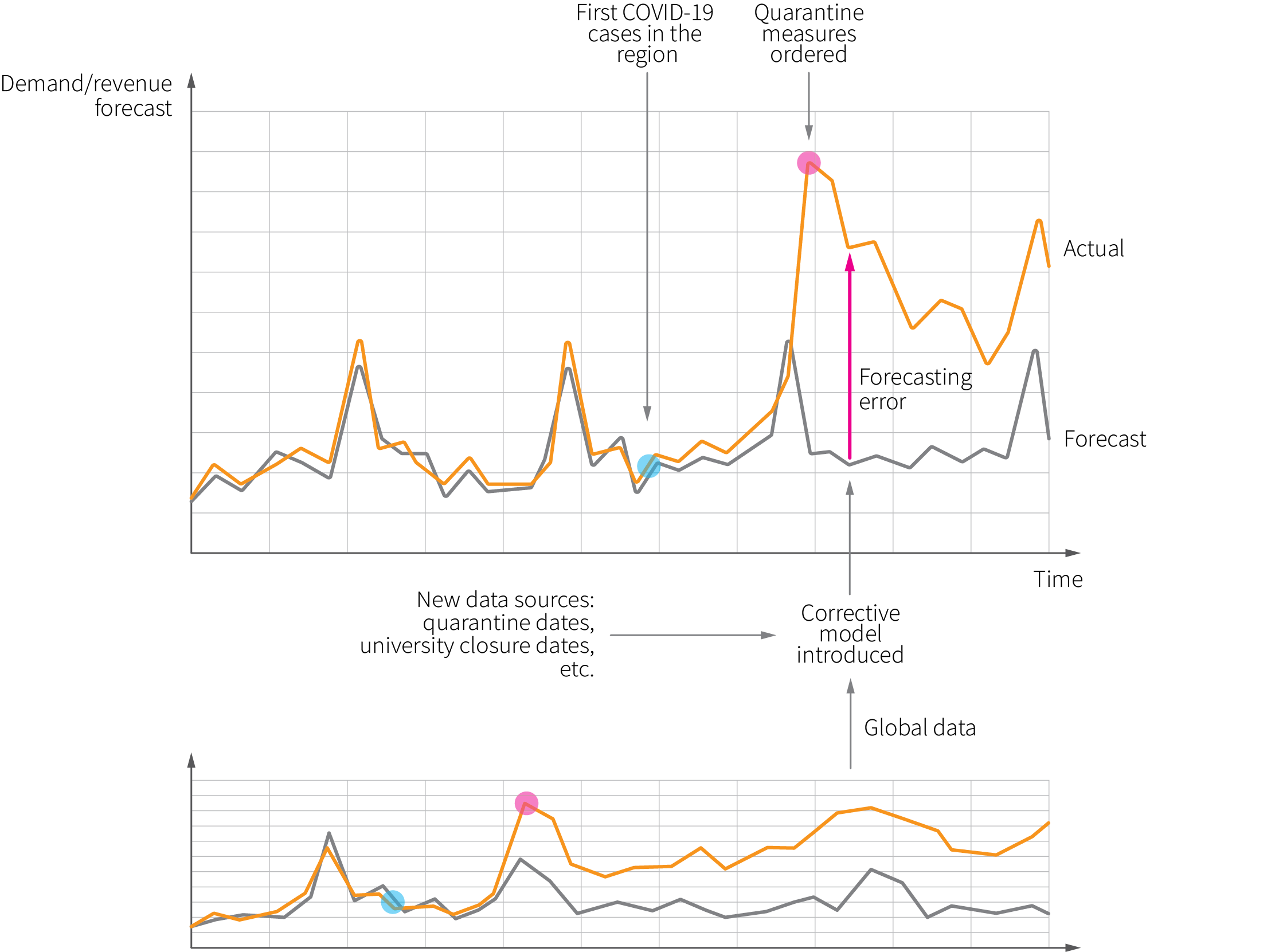

In this section, we provide an introductory case study based on one of our most recent projects for a media products company. This example highlights only one facet of the company’s COVID-19 response strategy, but it clearly showcases the importance of data analytics and the ability to react to a disruption rapidly. In the next sections, we develop a more comprehensive framework.

Initial state. A leading developer of digital media products used a demand forecasting model to optimize pricing and promotional decisions across more than 70 countries, multiple product lines, and multiple digital and retail channels. The model was able to forecast weekly demand numbers for up to 24 months ahead with reasonable accuracy. The system generated multiple forecasts for different discount levels, and pricing managers used these forecasts to understand how price elasticity would change over time and to determine optimal promotional times and depths.

Challenge. The company faced an unprecedented problem when the COVID-19 outbreak in China and subsequent quarantine measures rapidly changed the demand pattern, so the actual sales numbers quickly diverged from the forecast. In the case of media products, demand numbers sharply surged compared to the forecast. In a few weeks, it became clear that COVID-19 had turned into a global massive disruption that invalidated demand forecasts for all geographies.

Solution. The company made a decision to immediately update the forecasting models. After the initial analysis and experiments, the data science team decided to modify the existing solution as follows:

- A secondary demand forecasting model was introduced to estimate the forecasting error of the primary model, as shown in Figure 1.

- Additional signals, such as changes in quarantine measures and university closures, were incorporated into the models, which helped to improve accuracy.

- Global data were used to enable transfer learning across countries and leverage the experience of geographies where the pandemic had started earlier to forecast the trajectories in countries that were impacted later.

Figure 1. Adjustments to the demand forecasting model introduced as a part of the COVID-19 rapid response program.

Results. The model adjustments were implemented in about two weeks, which helped the forecasting accuracy to return to acceptable levels and stabilized the revenue management process. This was a major contribution toward the resilience of the company in this time of crisis.

The analysis and modeling of demand shocks also produced useful insights for operations and leadership teams. For example, it turned out that the demand in Asian countries (e.g., China, South Korea, and Japan) surged much more rapidly after the introduction of quarantine measures compared to European countries, the United States, Canada, and Australia. This helped to segment countries into several groups and facilitate the analysis and operationalization of the insights produced. Another helpful insight for the operations teams was that the disruption affected not only the selling numbers but also product usage patterns.

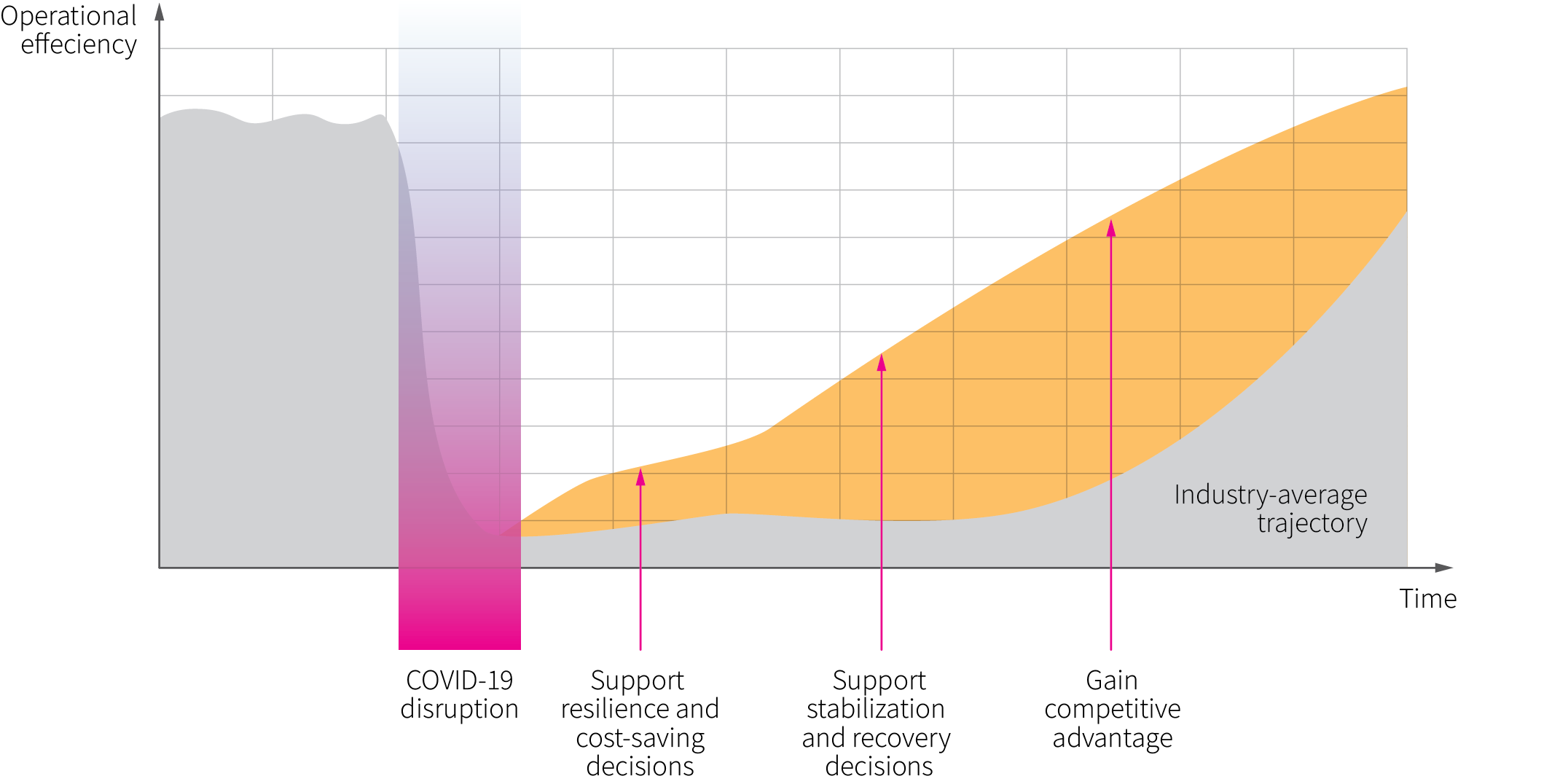

Step 1: Define the Recovery Strategy and Milestones

COVID-19 is disrupting ongoing operations and imposing uncertainty on future plans, so it has become very challenging to adopt a course of action that will strike a proper balance between resolving immediate issues and positioning an organization to rebound. The development of a balanced strategy can be facilitated by framing the problem as the development of incremental advantages compared to the industry-average trajectory:

- Short-term advantages. The immediate goals and milestones are focused on making high-quality decisions with regard to cost savings and supply chain resilience. This policy aims to minimize damage and stay above the industry-average loss curve.

- Mid-term advantages. Mid-term milestones include preparation for the recovery phase so that customer engagement, price management, and supply chain operations are properly supported by analytics and optimization tools and capabilities. The aim is to recover more efficiently in situations where competitor operations and analytical capabilities are disrupted.

- Long-term advantages. In the long run, the goal is to secure enterprise resources and use the shutdown and recovery time strategically to gain a competitive advantage. This phase includes the development of new functional capabilities that have been postponed by other market players because of the COVID-19 crisis.

Data analytics and engineering capabilities can contribute significantly toward all of these categories of objectives by providing more accurate forecasts, decision support and optimization tools, and high-impact customer-facing features. We present a framework for planning and rapidly developing these capabilities in the coming sections.

Figure 2. A conceptual framework for planning COVID-19 response activities.

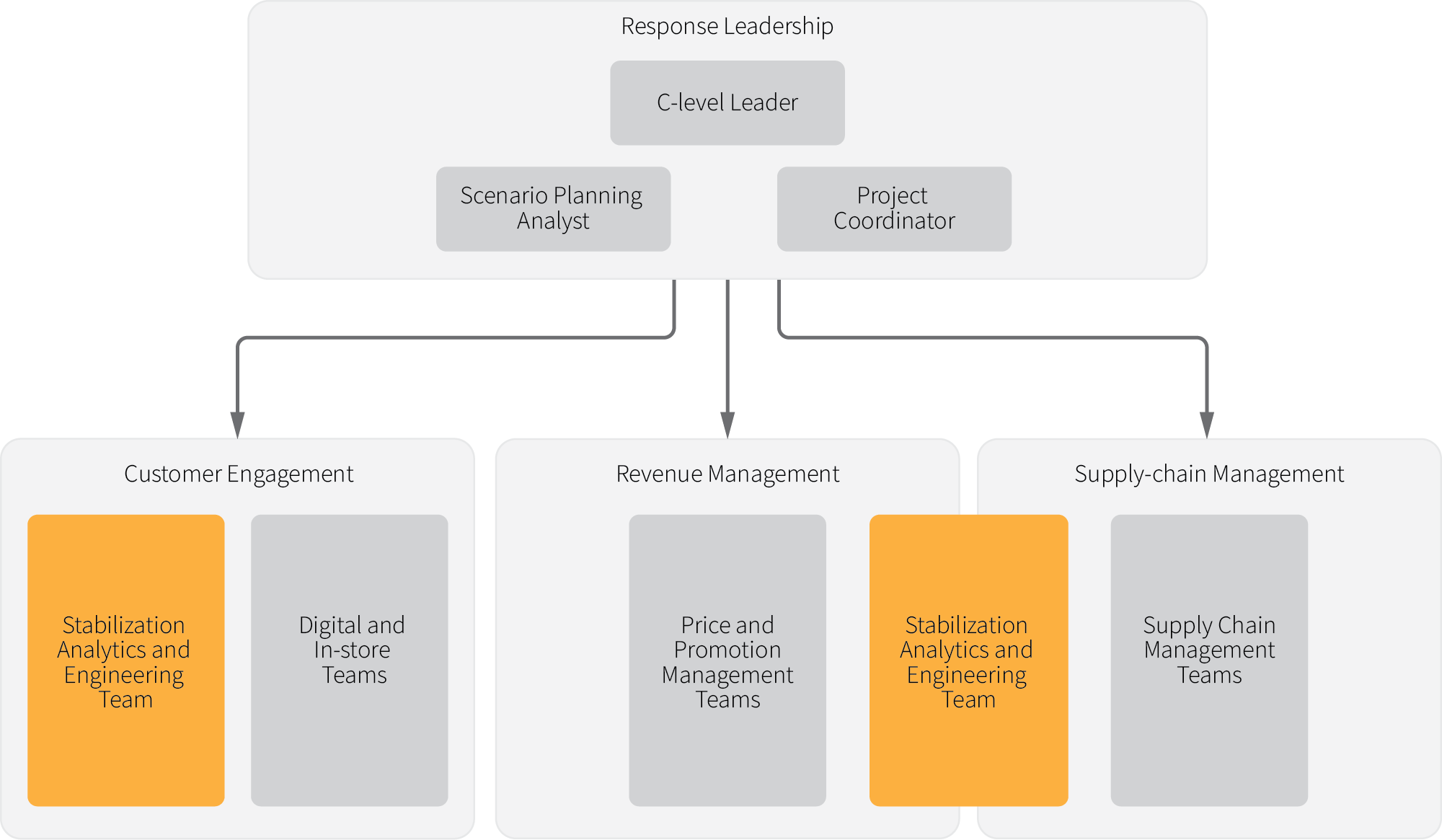

Step 2: Create Stabilization Analytics and Execution Teams Using Top Talent

The value added by analytics during the COVID-19 stabilization and recovery period can be significant. Consider the following use cases that are directly linked to revenue and cost optimization:

- Forecast store openings after a lockdown

- Forecast the demand recovery trajectory after a lockdown

- Optimize pricing and promotional decisions in a time of upheaval

- Optimize supply chain decisions based on agile forecasts

- Reduce customer churn in times of turbulence

Solving these use cases using descriptive and/or predictive analytics is challenging for a couple of reasons. First, the development and delivery of analytical and data science projects usually takes a considerable amount of time. Second, COVID-19 is a unique situation, so patterns and models learned from historical data might be inapplicable under these new conditions.

Some leading companies are working through these challenges by creating special analytics teams (S.W.A.T. teams) that are tasked to quickly develop simple but valuable tools and models for the above use cases. These teams usually include highly experienced data scientists and data analysts who are able to develop non-standard solutions rapidly. S.W.A.T. teams need to be closely integrated with execution teams and provided with strong support from COVID-19 response leadership. A typical setup is illustrated in the organizational diagram below.

Figure 3. An organizational framework for rapid COVID-19 response with data-driven corrections and optimizations.

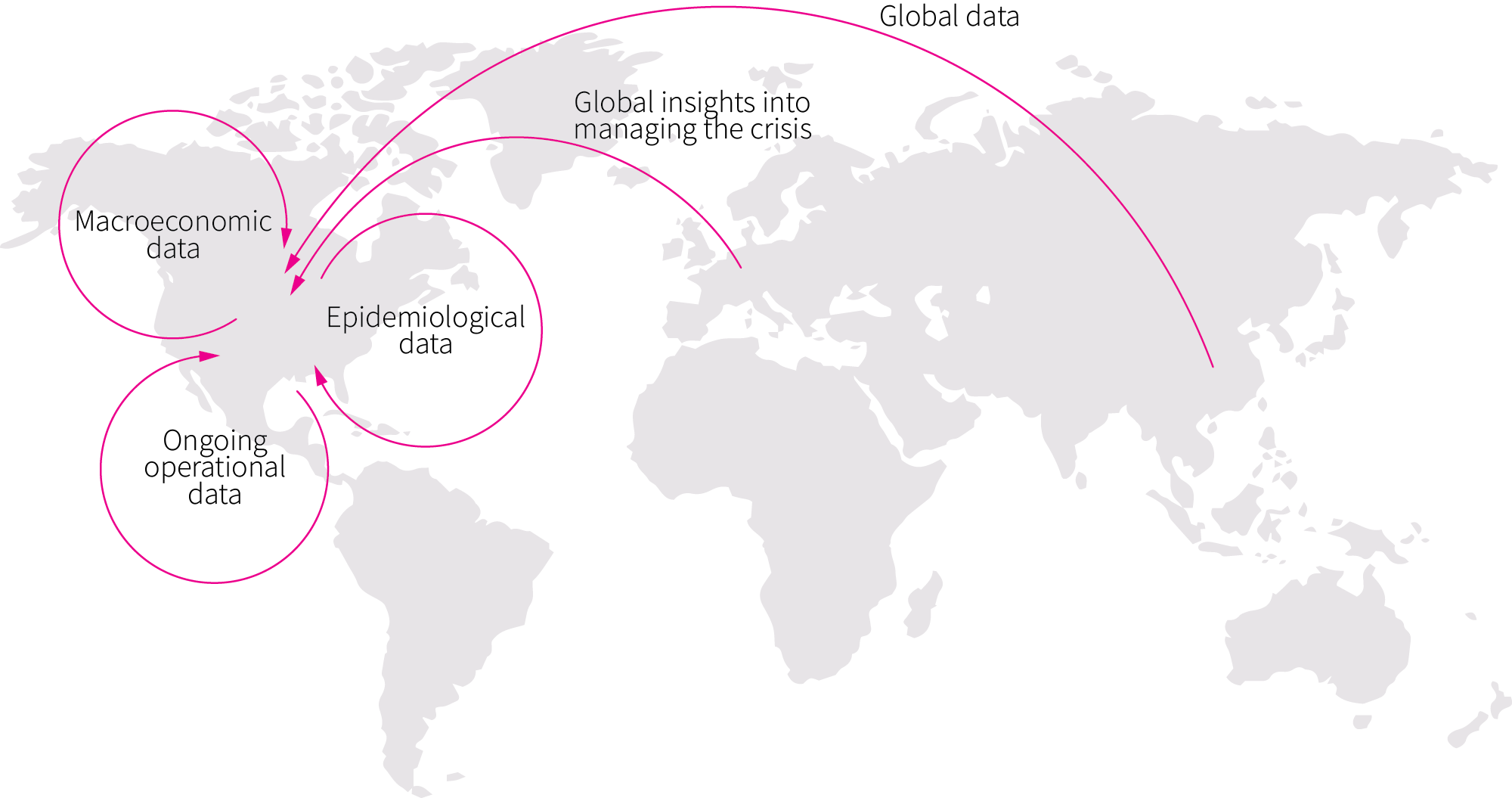

Step 3: Prepare Ahead with New Data Sources, Forecasting, and Simulation

The analytical, forecasting, and optimization problems posed by the COVID-19 disruption can be highly non-standard and thus can require innovative solutions. The following real-life examples show how companies are working through these challenges by using uncommon data sources, quick adjustments of existing models, and new forecasting capabilities:

- Incorporate new data sources. Some international companies are trying to forecast their post-lockdown store opening schedule based on data from their offices in China, South Korea, and other countries where the pandemic started earlier than in the United States and Europe. This is a challenging problem because it requires the use of data sources that are not commonly utilized in demand analytics, such as overseas, macroeconomic, and epidemiological data. This type of problem can be tackled only by experienced teams with enough domain knowledge and data science skills to develop a useful (but not necessarily perfect) solution in a very short time period.

- Adjust existing models or use them differently. It is often possible to adjust or repurpose existing forecasting and optimization solutions to make them useful in a time of turbulence. For example, some companies have managed to quickly adjust their promotion optimization models to capture additional revenues during demand shocks. We provided a real case study on this scenario in the introductory section. However, making such adjustments in an emergency mode is not trivial and requires strong data science skills.

- Rapidly develop scenario planning models for the most critical functions. Enterprises cannot escape the necessity of operating in highly uncertain conditions imposed by the COVID-19 crisis, but they can better assess risks and react to disruptions more quickly using what-if analysis and simulations. A number of companies from China reported that they have managed to respond to shocks efficiently by continuously evaluating how production and distribution capacities can be reallocated under new constraints (border closures, plant shutdowns, demand drops or surges, etc.) and making adjustments accordingly. One can consider implementing the same approach either through using existing supply chain planning capabilities or through the rapid development of new specialized models.

Figure 4. Common adjustments to data sources and model designs in response to COVID-19 disruptions.

Step 4: Improve the Planning–Execution Cycle

Analytical capabilities cannot be properly developed and used outside of the operational context. For example, even an accurate demand forecasting or price optimization model aligned with the new reality of coronavirus disruptions might not be helpful if the supply chain and pricing operations are not properly adjusted to operate under higher uncertainty. The common adjustments that one should consider implementing include the following:

- Reduce the timeframe of the planning–execution cycle. High uncertainty and volatility generally require reviewing forecasts more frequently and making more manual corrections. For example, a weekly promotion review and re-optimization cadence can be replaced with a daily cadence.

- Prepare for frequent changes in production and logistics. During a crisis and recovery period, priorities can change frequently because of logistics constraints imposed by lockdowns and border closures, issues with suppliers, and demand shocks. Scenario planning and simulations help organizations to evaluate options and make the right decisions on how production and logistics capacities should be reallocated, but companies also need to work on reducing set-up times and making other improvements to adaptability.

- Improve focus on high-demand areas and items. When disruptions are unavoidable, companies have to focus on what is in high demand and profitable. Prioritization needs to be done across the value chain: product variety should be reduced, production and buying plans should be revised toward high-demand categories, inventory and staff should be redeployed to high-demand areas, and more transport capacity should be allocated to high-demand products. These activities need to be properly supported by analytics and scenario planning.

- Improve supply chain visibility and evaluate alternative suppliers. Regular scenario planning might not evaluate the internal risks of Tier-1 and Tier-2 suppliers, but understanding the upstream disruption risks is essential during the crisis. This requires both gaining greater visibility of suppliers’ inventory and production statuses and incorporating these data into analytics and scenario planning models.

- Improve focus on workforce analytics. The example of China shows that labor shortages can be one of the biggest disruptors of production and warehousing. First, workforce mobility can be impacted by lockdown measures and facility closures. Second, the direct impact of the disease can be very significant: when one worker tests positive, all people he or she has contacted have to be put into quarantine. Companies should account for labor-related disruptions during scenario planning and prepare to respond accordingly.

Step 5: Enhance Customer Engagement Capabilities

We can observe today how the pandemic is changing the way in which customers want to engage with companies. From Asia and Europe to the United States, industry leaders are adopting new ways to engage with customers while addressing safety concerns and helping communities. We can say with full confidence that digital transformation has become a matter of survivability for businesses, and it will be crucial in the next several months.

While not all companies entered the crisis on an equal footing, corporate and technology agility is the defining factor of who will emerge as leaders after the dust settles and the new world takes shape. For example, while grocery delivery companies, such as HelloFresh, are seeing a natural surge in demand due to their business model[1], traditional retailers, such as Walmart or Walgreens, are switching to fully contact-free services[2] and are expanding drive-through shopping[3], helping them address customer concerns and win business in the long run. Companies in the media, telecommunications, and gaming industries will face challenges with retaining customers when the load on their services increases and discretionary spending shrinks. Financial services companies will face challenges with a slowing economy, along with customer issues ranging from inability to make regular payments due to job disruption to protection of wealth in the situation of a stock market crash.

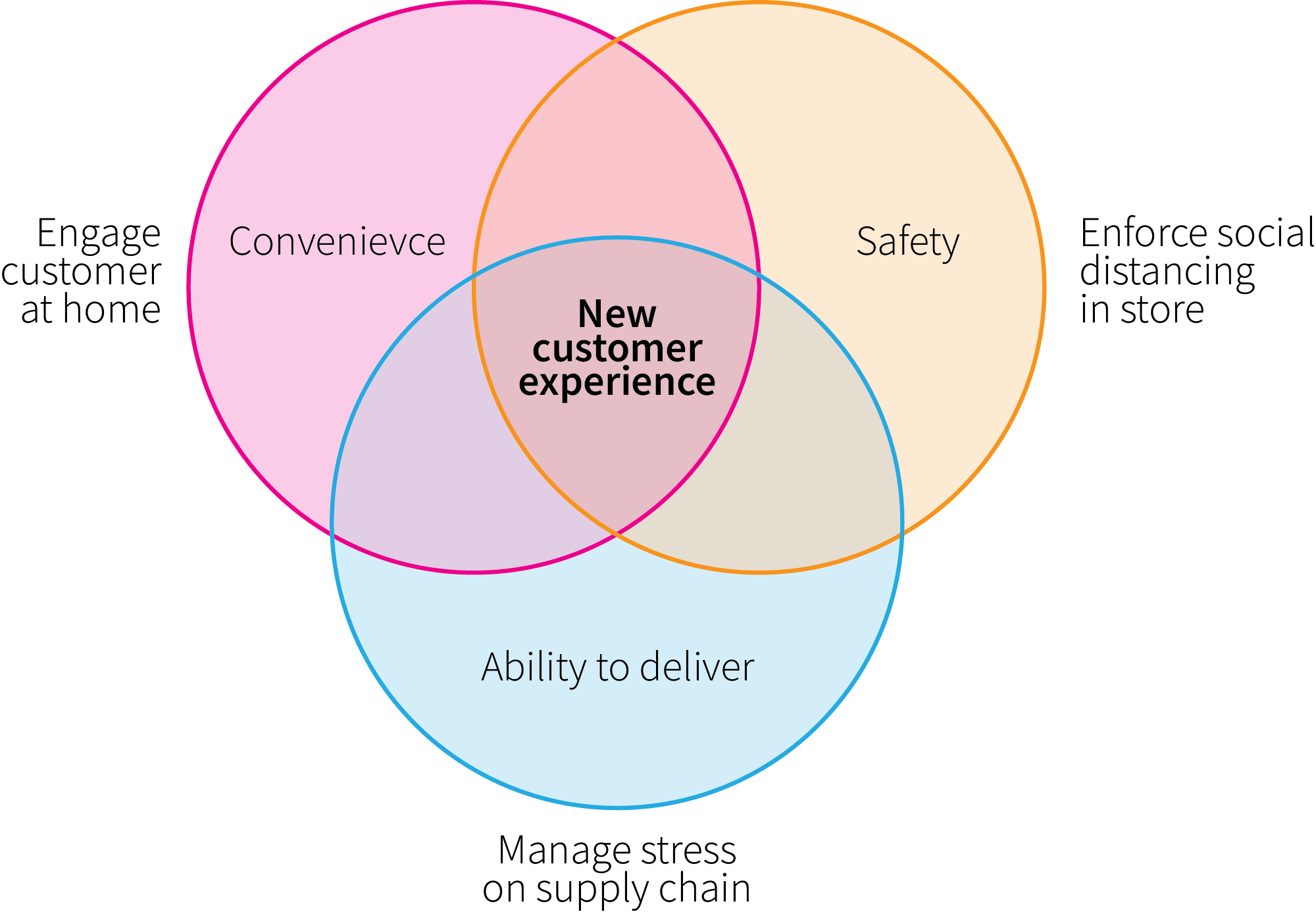

There are three major drivers behind the emerging changes in customer engagement:

- Convenience. Many states in the United States have implemented shelter-in-place orders, and social distancing guidelines have been applied nationwide. Most of Europe is locked in quarantine. If customers cannot engage with a company from home or within the limited time in which they are allowed to go out into the street, that company will lose business. If the online platform cannot scale to the surging traffic, customers will look for alternatives. Hence, it is crucial to provide customers with the best service online and use digital channels in stores as much as possible. Convenient customer interfaces, high-performance platforms, transparency on pricing and inventory availability, home delivery, and the option to buy online, pick up in store are becoming paramount.

- Safety. Customers do not want to get infected with coronavirus, and they will expect companies to provide a safe experience when physical contact or visits to stores and branches are inevitable. Companies will need to develop new capabilities to enforce social distancing, prevent overcrowding, and detect visibly infected customers and provide alternative services to them, as well as protecting customers and the workforce from spreading infections in stores, branches, offices, and warehouses.

- Ability to deliver. While some industries and companies are suffering from a dropping demand, others are undergoing a sudden surge in demand with an insufficient supply. The infamous toilet paper crisis in the United States depleted shelves in major stores across the country. Similar shortages of kitchen paper products, eggs, rice, pasta, and other products have put companies’ fulfillment and supply chain infrastructures under enormous stress. While it is very difficult to predict such shortages, which can quickly spread through rumors (we can remember the great toilet paper scare of 1973[4]), the stress of such a crisis can be prevented with enough transparency and agility in fulfillment and supply chain management systems.

Figure 5. The major drivers behind recent changes in customer engagement.

Based on the current state of the industries, there are a number of customer engagement scenarios that companies should invest in to address the above goals:

- Real-time product availability. Research on out-of-stock items in grocery stores said that by the end of March 2020, the percentage of out-of-stock products increased from 1% to 20%. At the time of writing, products in high demand, such as toilet paper, kitchen towels, rice, and pasta, are difficult to find in stores. And almost nothing leads to higher dissatisfaction for a customer than visiting a store and not finding one out of three products on their shopping list. To address this challenge, some grocery retailers are implementing rationing. Unfortunately, this strategy is often implemented by placing paper stickers in stores. Instead, retailers can implement a real-time view into store inventory and availability that is refreshed every several minutes. In addition, stores can communicate to customers when an item is in or out of stock, when new shipments are expected, and when the product can be usually found in the stores. This will improve the convenience of shopping.

- Pre-orders and reservations. In addition to real-time notifications about product availability, retailers can implement reservation functionality in which a customer can get in a virtual line for a particular product. When a new shipment comes in, it will be reserved for the customers who placed a pre-order for that item. Implementing this capability will address both convenience and safety, as it will prevent crowding in stores. Implementing and advertising this functionality will incentivize customers to install mobile applications from a retailer, building higher customer loyalty in the long run.

- Rationing and quotas. The retailer policies around rationing can be combined with the features above and enforced by embedding policies in online and in-store shopping carts. This measure will not only relieve stress on the supply chain and fulfillment, but, combined with the previous features, it will increase customer confidence by enabling longer-term planning and ensuring that the promised ETAs on product availability are met.

- Contactless checkout. The modern technologies of RFID sensors, barcode scanners, computer vision, and contactless payment systems can help implement a new checkout experience in stores. This will increase convenience and improve customer safety.

- Connected stores and warehouses. Adding a contactless checkout to stores is only the tip of the iceberg and is the first step toward a truly connected store. Adding cameras with advanced computer vision techniques to monitor store capacity, control overcrowding in particular areas of the store, and prevent the access of visibly infected individuals will improve the safety of customers and store assistants. Adopting RFID scanners and computer vision for inventory cycle counting will improve efficiency and safety. Utilizing real-time analytics in stores will help in the long run with increasing the efficiency of store operations. Extending the above capabilities to warehouses and increasing reliance on automation will improve the efficiency and safety of the workforce.

- Real-time pricing and promotions. Reacting to customer demand by implementing real-time pricing and promotion decisions can not only help optimize revenue and profit but can also help reduce stress on the supply chain by taking a store’s available inventory and processing capacity into account.

- Adding planning tools. Taking companies like Blue Apron and HelloFresh as examples, traditional grocery stores can implement meal planning tools in their shopping apps. Adopting true meal-based delivery may require making more changes and building additional capabilities, but even a simple recipe-based shopping experience can dramatically improve convenience.

- Enabling home delivery and in-store pickup. Many companies have already implemented home delivery and curbside pickup. For those that have not, it is a good time to invest in this capability now. This step will improve convenience and safety and reduce supply chain stress.

- Reliability and performance. Shifting to digital channels dramatically lightens the load on customer experience platforms and backend systems. Every day is Black Friday. Besides the obvious short-term benefits, ensuring the reliability and performance of the systems will increase customer confidence long-term.

The list of scenarios above is not comprehensive but gives insight into how to survive and prosper in the new world. The list of capabilities will obviously grow as conditions change.

Step 6: Enhance Fulfillment and Supply Chain Capabilities

While new capabilities in customer engagement can relieve stress on fulfillment and supply chains, many companies will need to invest in renovating those systems. The digital transformation of the last few years was focused on customer experience; it has become evident that without agility in back-office systems, advances in front-office technology can quickly come to a halt. For example, even when a customer experience platform works well, department stores such as Macy’s and T.J. Maxx are turning off checkout functionality due to inability to fulfill orders. Improvements in the back office will be driven by four factors:

- Transparency. Companies will need to find ways to track real-time inventory across the supply chain, from vendors and fulfillment centers to stores. This inventory information will then be used to make reliable predictions on when customer orders will be shipped, communicate and notify in-store product availability to customers, generate reports with actual data for management, and send data to AI-driven decision engines for insights and optimization.

- Agility. Both the current volatility of the situation and customer demand make the ability to react rapidly to changes crucial for the survival of a business. The decisions that machine learning models recommend and management teams approve will need to be operationalized and implemented immediately.

- Risk management. The coronavirus pandemic has added a number of risks to supply chains and has increased the importance of reacting to these risks in real time. The closure of stores, fulfillment centers, and warehouses in some regions due to quarantine or shelter-in-place orders will affect many non-essential businesses. The number of suppliers and vendors experiencing issues due to demand spikes will increase. At the same time, dropping gasoline prices may create new opportunities. The ability to predict and react to such risks will dramatically improve a company's agility.

- Safety. The challenges that companies such as Amazon are facing with regard to infection of the workforce[5] will increase the demand to protect employees. These challenges will likely lead to further digitization of warehouses, fulfillment centers, and stores. Utilizing computer vision for inventory management and detection of sick employees, as well as relying on robotization and automation, will help companies to deal with the current pandemic and increase efficiency over time.

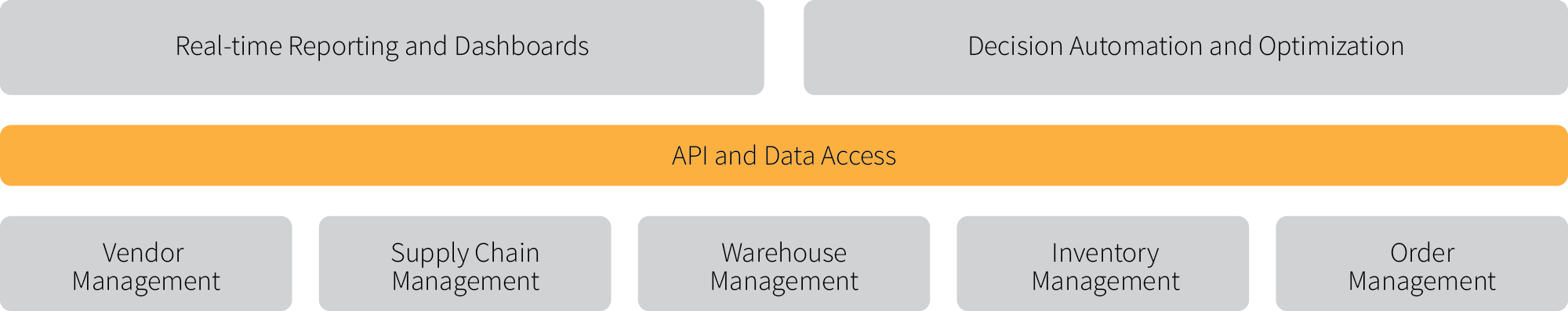

A company’s back-office IT ecosystem may be too complex to transform over a couple of months solely as a reaction to the current pandemic. However, in many cases, significant business value can be created by implementing tactical changes and modernization. Short-term improvements can be achieved by modernizing applications and systems to expose APIs and to provide access to internal data—in a batch or real-time streaming mode—by adopting event-sourcing patterns, as shown in Figure 6. Such APIs will provide enough transparency and agility to optimize supply chain and fulfillment decisions in real time. AI-driven decision engines can then be created to augment traditional, manual analytics. Some AI use cases of computer vision can be implemented on the side by installing cameras in warehouses and stores and implementing an IoT infrastructure to support analytics and decision making at the edge.

Figure 6. An API layer on top of supply chain–related systems and data sources improves transparency and facilitates the development of decision making and optimization components.

A deeper digital transformation of a company’s entire ecosystem can be started later, after the immediate gaps are closed. New use cases and best practices will appear as the world changes to a novel mode of operation, and the agility of technology and corporate teams will play a bigger strategic role than immediate fixes will.

Case Study: Supply Chain Optimization Services for a Home Improvement Retailer

We can illustrate the recommendations provided in this section with a case study of a leading home improvement retailer. The capabilities described in this study were developed and delivered several months before the COVID-19 outbreak, but they proved to be crucial for maintaining supply chain resilience during the crisis.

-

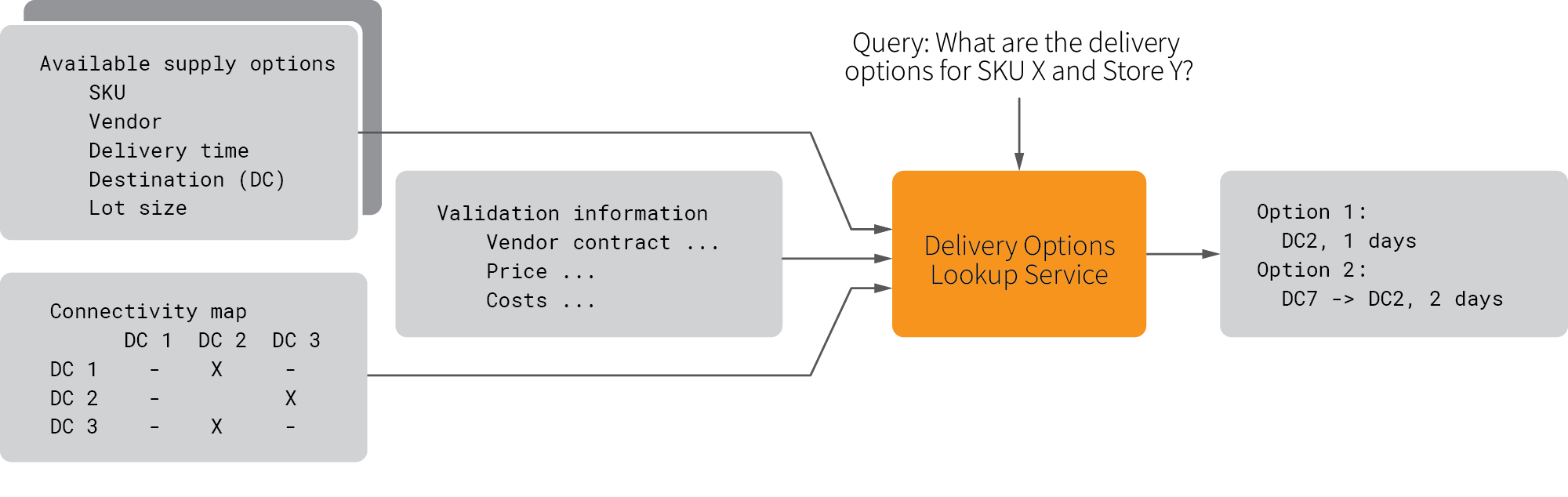

Initial State and Challenges. The leading home improvement retailer has a complex supply and distribution network with 60+ distribution centers and 2,000+ stores. There are several types of distribution centers in the network, including repackaging facilities that never store inventory, facilities dedicated to bulk products, facilities for same-day delivery, and others. Managing inventory flows across such a complex network is very challenging, and the retailer was looking to develop a set of decision support and planning services that would make the process more manageable and efficient.

-

Solution and Results. The company’s transparency of inventory and agility of supply chain management was improved by introducing multiple smart services for different groups of business users. Some of these services used statistical analysis and machine learning features to quantify and manage risks. The design of one of the services is illustrated in Figure 7. This service consolidates supplier data, contact validation information, and facility connectivity maps to recommend optimal delivery options for business users dynamically. An array of such services created a solid foundation for managing the supply chain in both good and bad circumstances.

Figure 7. Functional design of a service for looking up delivery options.

Step 7: Invest in Agility on Corporate and Technology Levels

Companies have been talking about agility for at least a decade. This pandemic is presenting an ultimate test for companies, which will either survive and prosper or lose market share and perish. The outcome of this test will come down to the agility of a company on all levels. As this pandemic will require companies to move to digital engagement models with customers, the agility of digital and technology organizations will be paramount.

A group of researchers focusing on technology organizations recently published a story proving that high-performance technology organizations are associated with higher corporate agility and better business performance[6]. Furthermore, the researchers identified 24 capabilities that are required to build high-performance technology organizations. These capabilities can be grouped into five categories:

- Culture. Generative culture[7], as well as a focus on constant learning and providing the necessary tools for a team, ensures high productivity without sacrificing quality. Facilitating cross-team collaboration enables the dissemination of best practices and spreads the best cultural traits within a company.

- Agile best practices. Agile processes help to identify and solve real pain points for both customers and internal business users quickly. Active monitoring of business and technical KPIs, as well as active experimentation, which is one of the key principles of agile methodology, ensures that the new features solve actual problems.

- Lean management. The lightweight process reduces barriers to implementing new functionality in production without sacrificing quality and reliability. Lean management reduces overhead and increases overall productivity.

- Architecture. Microservices architecture helps to scale a technology organization and to deliver hundreds of changes per day by splitting work into cross-functional teams that are self-sufficient and can deliver new features without depending on others.

- Continuous delivery. Reducing the time to market for new changes is a key ability for adapting to changing environments and customer preferences. Continuous delivery is a set of processes and technologies that helps technology teams to deliver software faster; it can reduce the lead time from months to hours when delivering a new feature in production.

Although building the right culture and processes from scratch in a company is a long process, it can be sped up by injecting a high-performance culture and talent from other companies. In many cases, collaboration with vendors can jumpstart the process, given the right engagement model. In a recent study, Forrester published a number of guiding principles that companies should look for in vendors[8].

Investing in building agility on corporate and technology levels is a long process. But in order to succeed in this crisis, companies have to start now. In the foreseeable future, agility will be one of the primary factors that will separate winners from losers.

References

HelloFresh reports strong demand due to coronavirus lockdowns, Emma Thomasson, March 30, 2020 ↩︎

We’re Making Key Services Completely Contact Free, Janey Whiteside, March 27, 2020 ↩︎

Walgreens makes it easier for customers to shop without leaving their cars, Dan Berthiaume, March 27, 2020 ↩︎

The Great Toilet Paper Scare of 1973, Zachary Crockett, July 9, 2014 ↩︎

Amazon warehouse workers walk out over coronavirus, Irina Ivanova, March 31, 2020 ↩︎

Accelerate: The Science of Lean Software and DevOps, Nicole Forsgren, Jez Humble, Gene Kim, 2018 ↩︎

Co-Innovate With Agile Development Service Providers To Deliver Better Software Faster, Duncan Jones, 2020 ↩︎