Revolutionizing Financial Services: AI and ML-driven customer 360 and personalization

The financial services industry plays an essential role in our daily lives, whether it's helping us manage our finances, purchase a home, or plan for retirement. By offering a wide range of financial products and services, such as loans, credit cards, insurance, investment management, and payment processing, the industry helps simplify complex financial transactions and makes them more accessible to everyone. That's why it's more important than ever for forward-thinking companies in the banking, financial services, and insurance (BFSI) industry to embrace an artificial intelligence (AI) and machine learning (ML)-driven 360° customer view.

As the financial services industry continues to evolve, so do the expectations and needs of its customers. Financial service providers need to understand their customers' needs, preferences, and behaviors to deliver optimized customer experiences. In the age of big data and AI, the key to achieving this is data-driven customer intelligence and personalization. At its core, a 360° customer view offers a holistic view of customers, bringing together data from internal and external sources to create a complete picture of their identifying and account information, behaviors, preferences, and needs. By leveraging this data, financial service providers can gain insights into their customers' wants and needs, enabling them to effectively tailor their services. This can lead to improved customer experiences, higher levels of customer satisfaction, and, ultimately, increased loyalty and revenue.

Moreover, a 360° customer view enables companies to understand their customers' journeys better, from initial contact to ongoing interactions. This understanding can help financial service providers to optimize their marketing and sales strategies, improve the customer acquisition process, and enable more effective engagement and retention strategies.

Let’s dive deeper into the need for embracing a 360° customer view and how it can benefit the financial services industry.

Why is there a need for 360° customer views in the BFSI industry?

The financial services industry is an expansive and multifaceted sector, encompassing a diverse array of businesses and organizations that provide financial products and services to individuals, businesses, and governments. This includes banks, credit unions, investment firms, insurance companies, accounting and tax preparation services, financial planning firms, and countless others. As a pivotal player in the global economy, the financial services industry performs a crucial role by facilitating the flow of funds and capital between investors and borrowers. Among the critical services financial institutions offer are payment processing, lending, investment management, risk management, and insurance. Providing these services mandates a high level of trust and confidence from customers, and as such, customer satisfaction and loyalty are essential for financial service providers. To this end, one effective tool that these providers can use to ensure customer satisfaction and loyalty is an AI and ML-driven customer 360° and personalization strategy.

In-depth analysis of customer data

The financial services industry has a wealth of customer data, but not all of it is equally useful in identifying their needs. That's where customer intelligence and the Next Best Action Model come in. Financial service providers can supplement the primary data on their internal servers with data from other communication channels using predictive analytics and modeling tools.

Grid Dynamics has built customer intelligence and analytics platform solutions that collect first- and third-party data, which feed into statistical models for lead scoring. These solutions can be integrated with transactional systems, marketing automation software, and external advertising platforms. First-party data could include basic customer information like income, age, occupation, and additional details for plans or accounts that include family members. Third-party data might comprise social media, online purchase history, and IoT sensor data. By optimizing this data in a customer 360° view, financial service providers can automate much of the daily decision-making process related to customer acquisition and retention, and offer more personalized user engagement to customers.

Furthermore, AI and ML algorithms can identify behavioral patterns, market trends, competitor actions, geopolitical events, weather signals, and so on to provide valuable insights that improve customer retention rates, risk analysis, fraud detection, and message targeting. Focusing more on core business processes allows financial service providers to optimize customer experiences, increase customer loyalty, and drive revenue growth.

Customer satisfaction

When a customer applies for a mortgage, a loan, or an insurance policy, they make significant financial decisions that require a robust level of confidence in their provider. If the process is too complicated, unclear, or if customers aren’t receiving sufficient customer support, they may become frustrated and consider taking their business elsewhere. In addition, customers expect to be able to access their account information easily, receive prompt responses to inquiries and requests, and resolve their issues quickly. That's why prioritizing customer service is crucial for maintaining customer loyalty, building trust, and ultimately retaining business.

Financial service providers offer complex products and services that require knowledgeable and empathetic support for customers to be able to navigate them effectively. Moreover, financial service providers must be able to handle issues related to fraud, identity theft, and data breaches swiftly and proactively. Unresolved issues of this nature can significantly damage the company's reputation and lead to customer loss. Financial service providers can outperform their competitors by prioritizing customer service and increasing customer loyalty in the long term.

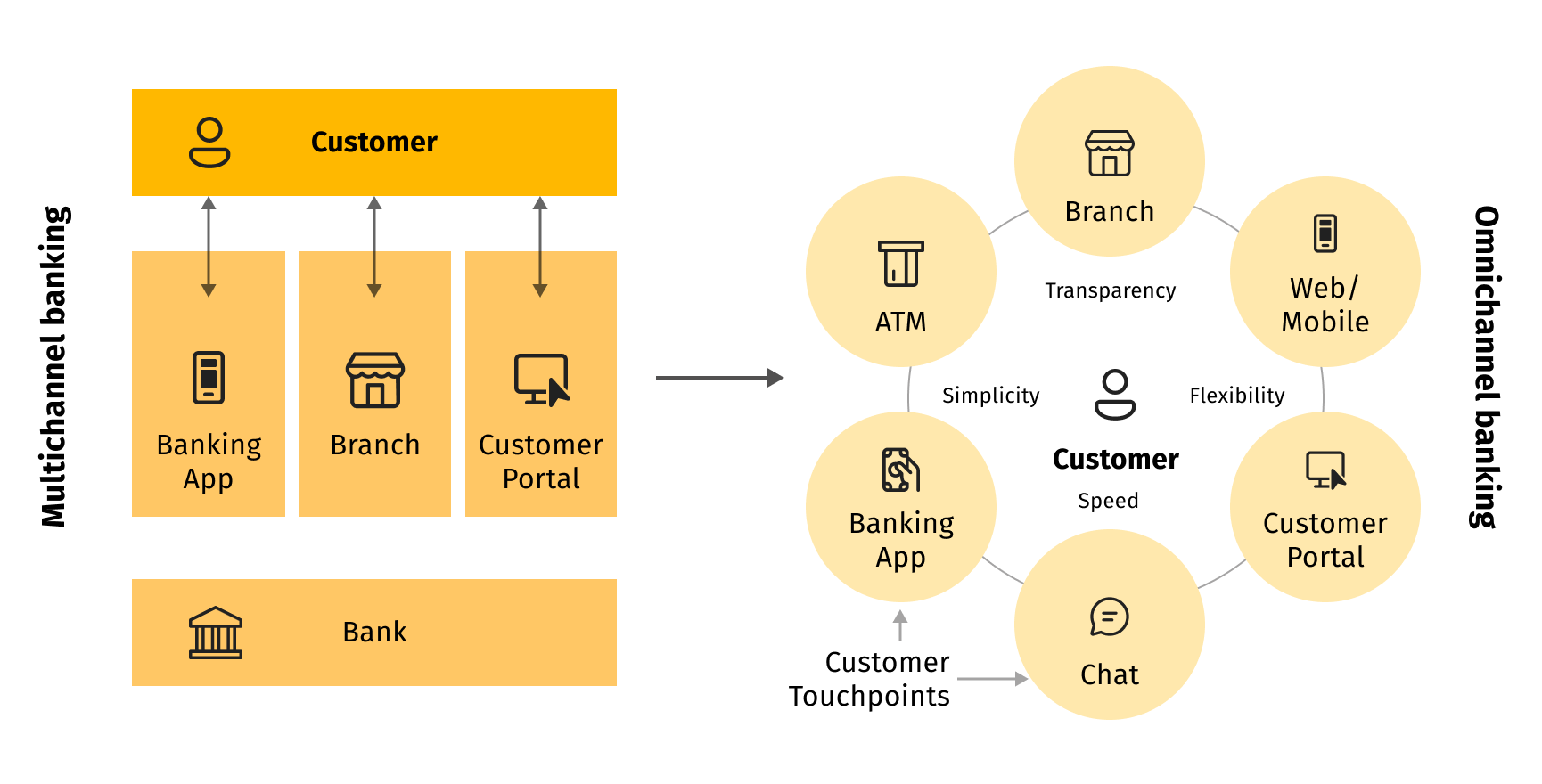

To remain competitive in today's fast-paced digital landscape, financial service providers must focus on streamlining their claims handling and service delivery processes. One practical approach is implementing an automated, omnichannel platform for filing applications, claims, and lodging complaints or service requests. This lets customers access their policy and account details via their preferred channels using any device, greatly simplifying the entire process.

Financial service providers can gain a 360° view of each customer's needs by aggregating this data into a single source, enabling agents to respond faster and more efficiently to customer inquiries and complaints. Additionally, this data can be used to develop targeted marketing and sales strategies that help to increase customer loyalty and retention rates.

Ultimately, an automated, omnichannel approach improves the overall customer experience, reduces the time and effort required to file claims or applications, and enhances the efficiency and effectiveness of customer service teams. This leads to increased customer satisfaction, improved brand reputation, and long-term business success.

AI-driven workflows

Conversational AI systems, powered by deep natural language processing capabilities, enable customers to interact with virtual assistants, and get necessary information. The system stores and processes every interaction, allowing it to perform information retrieval through semantic searches and structured queries. This provides customers with in-depth and relevant information whenever they need it, regardless of their location. As the conversational AI system accumulates more data from customer interactions, it becomes better equipped to provide more accurate and personalized responses to meet their needs.

Personal finance management

AI-driven workflows offer multiple use cases for how the financial services industry can benefit from this technology. One such use case is the deployment of virtual assistants to aid customers in personal finance management. By leveraging AI technology, financial service providers can offer personalized advice and recommendations to customers based on their financial goals, risk tolerance, and spending patterns. This, in turn, empowers customers to manage their finances better and make informed decisions.

Fraud detection and prevention

AI also has a role to play in fraud detection and prevention, where it can help financial institutions prevent fraud and reduce losses by monitoring transactions and flagging suspicious activity. Moreover, AI assistants can help financial institutions identify and mitigate risks in their portfolios, monitor credit and market risks, and identify emerging risks based on market trends and data analysis.

Customer service

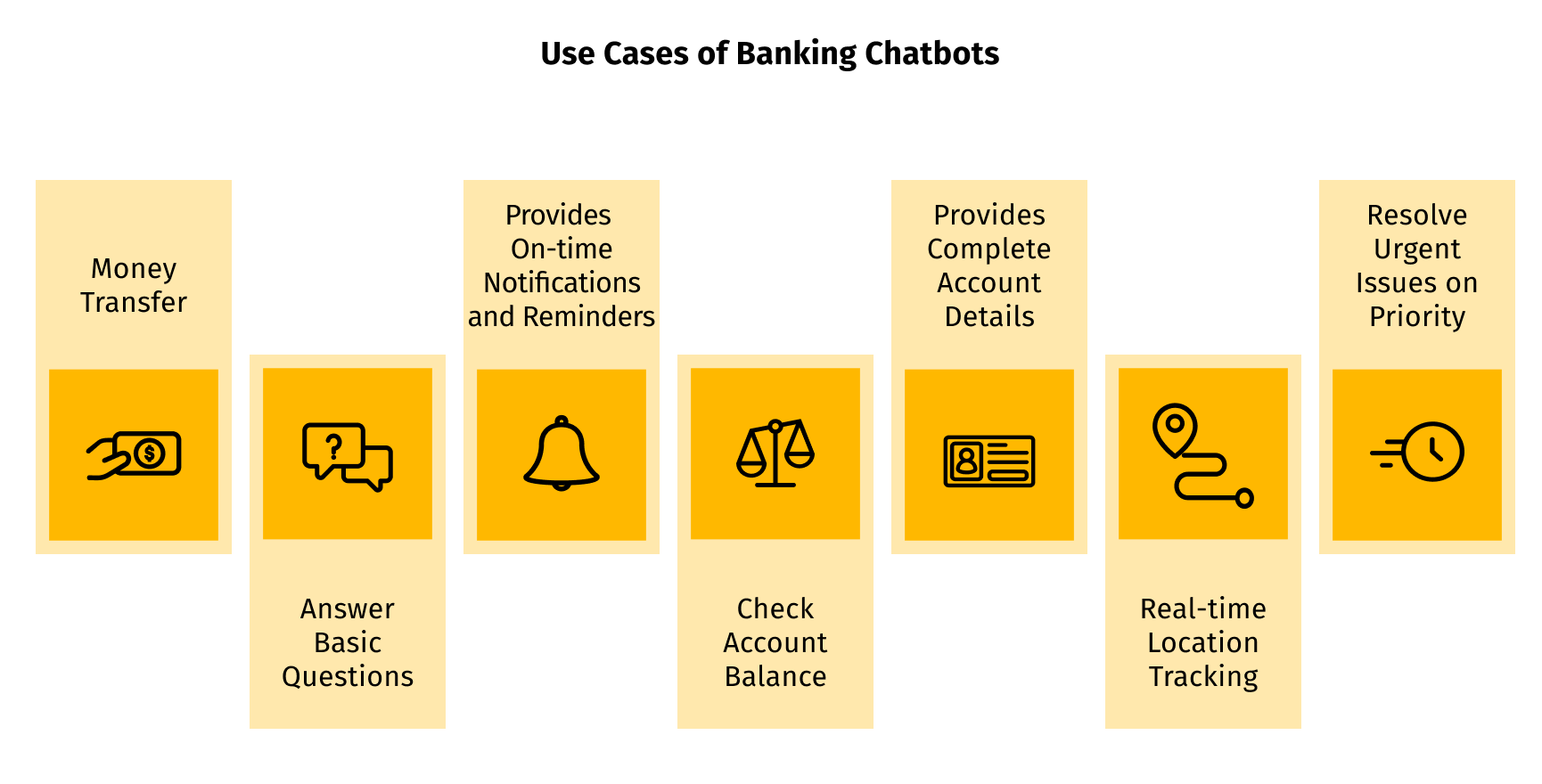

Customer service is another area where AI can have a significant impact. By providing 24/7 virtual assistance to customers, AI-powered chatbots can answer common questions, reduce call center wait times, and improve customer satisfaction. In investment management, AI can provide real-time market data and analysis, as well as personalized recommendations based on the customer's investment profile and preferences.

Grid Dynamics is at the forefront of developing conversational AI systems for Fortune 1000 businesses. Our developers utilize open-source software libraries, such as TensorFlow or PyTorch, to implement deep learning techniques and build bespoke language models specific to your business domain. This ensures that your conversational AI system clearly understands your customer base and their needs, whether in the financial services industry or any other industry. Moreover, the conversational AI system can be supported by Google Home, Alexa, Facebook Messengers, and more.

What is needed to achieve a customer 360° view?

For financial services companies, creating a customer 360° view may seem complex, but many tools are available to assist in the process. In addition to the Next Best Action Model, omnichannel user experiences, and conversational AI models mentioned earlier, it is vital to have a platform to process and analyze the data – that’s where the Grid Dynamics Analytics Platform and Machine Learning Platform come into play.

Grid Dynamics Analytics and Machine Learning Platforms

With Analytics and Machine Learning Platforms, banking, financial services, and insurance companies can gather and analyze data from various sources, creating a unified view of the customer. The platform allows for advanced analytics and data visualization, making it easier to identify trends and patterns that can help improve customer experiences and increase customer satisfaction.

Grid Dynamics understands the importance of a robust data platform for fully understanding each customer. Drawing on years of experience in data analytics, machine learning, and cloud computing, we've created AWS and Google Cloud Analytics Platform Starter Kits that are optimized for data-intensive enterprises. Our platforms accelerate insights, enhance data quality and accessibility, and simplify the implementation of 360° customer views.

| Google Cloud Platform | Amazon Web Services |

| Analytics Platform Starter Kit for GCP | Analytics Platform Starter Kit for AWS |

| Machine Learning Platform Starter Kit for GCP | Machine Learning Platform Starter Kit for AWS |

In the past, many financial services companies stored their data in on-premise EDW software, which can limit scalability and technological advancements. With Grid Dynamics, we help migrate your data to the cloud, making data processing more scalable and efficient. Optimizing data-driven processes allows you to gain a competitive edge in highly competitive markets.

360 degree customer view financial services: Summing up

By harnessing the power of data-driven customer intelligence and leveraging a customer 360° and personalization strategy, companies in the BFSI industry can provide customers with the personalized experiences they crave. With a complete picture of customers' preferences and behaviors, financial service providers can optimize their services and enhance customer satisfaction and loyalty, leading to increased revenue growth. That's why understanding customer journeys is crucial to developing effective marketing and sales strategies and driving successful customer acquisition and retention strategies. Stay ahead of the game and implement a 360° customer view to take your financial services to the next level.

Grid Dynamics is a digital-native technology services provider that accelerates growth and bolsters competitive advantage for Fortune 1000 companies. We have more than 15 years of experience in digital transformation and software innovation, most notably open-source, and cloud-native programs.

Still have questions about 360-degree customer views in the BFSI industry? We’d love to hear from you!